Today, over 90 percent of all business entity tax returns are prepared using software or with preparer assistance. Requests for additional information or copies of the form and instructions should be directed to Sara Covington, at (202) 317-6038, Internal Revenue Service, Room 6526, 1111 Constitution Avenue NW, Washington, DC 20224, or through the internet, at End Further Info End Preamble Start Supplemental Information SUPPLEMENTARY INFORMATION: Start Further Info FOR FURTHER INFORMATION CONTACT: ADDRESSES:ĭirect all written comments to Laurie Brimmer, Internal Revenue Service, Room 6526, 1111 Constitution Avenue NW, Washington, DC 20224. Written comments should be received on or before Decemto be assured of consideration. The Internal Revenue Service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other Federal agencies to take this opportunity to comment on proposed and/or continuing information collections, as required by the Paperwork Reduction Act of 1995 (PRA). Internal Revenue Service (IRS), Treasury. Provide legal notice to the public or judicial notice to the courts. Rendition of the daily Federal Register on does not

Until the ACFR grants it official status, the XML

Legal research should verify their results against an official edition of

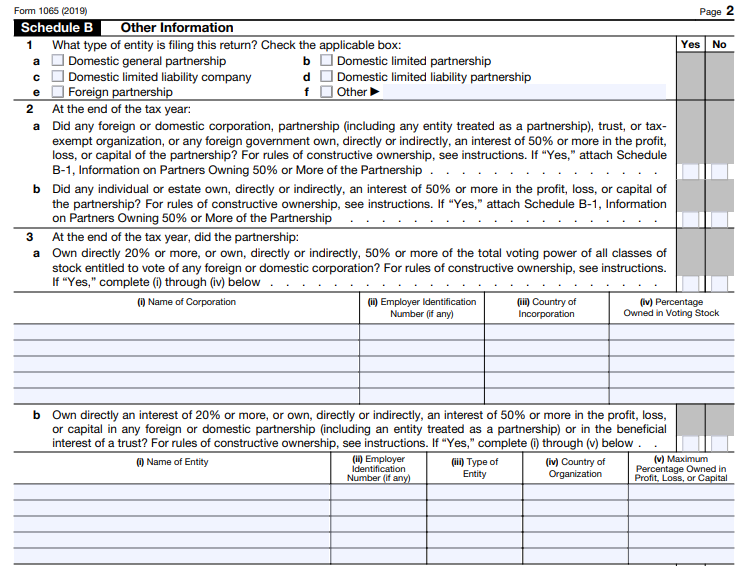

#FORM 1065 TAX PDF#

The official SGML-based PDF version on, those relying on it for The material on is accurately displayed, consistent with While every effort has been made to ensure that Regulatory information on with the objective ofĮstablishing the XML-based Federal Register as an ACFR-sanctioned The OFR/GPO partnership is committed to presenting accurate and reliable Register (ACFR) issues a regulation granting it official legal status.įor complete information about, and access to, our official publications Informational resource until the Administrative Committee of the Federal This prototype edition of theĭaily Federal Register on will remain an unofficial Each document posted on the site includes a link to theĬorresponding official PDF file on. The documents posted on this site are XML renditions of published Federal Register, and does not replace the official print version or the official It is not an official legal edition of the Federal What is the penalty for filing a Form 1065 late? The penalty is $210 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were partners in the partnership during any part of the partnership’s tax year for which the return is due.This site displays a prototype of a “Web 2.0” version of the dailyįederal Register.

0 kommentar(er)

0 kommentar(er)